【Sources: Bloomberg Asia】

Chinese Resale Site's 40% Discount Erode Luxury Giants' Profits

Over the past decade, China’s luxury market has been a major driver of growth for global high-end brands. However, a new and emerging competitor—online luxury resale platforms—is beginning to disrupt this market, chipping away at traditional profits.

Luxury powerhouses like LVMH and Kering SA are facing a fast-growing foe in China: an e-commerce platform called Dewu (also known as Poizon) that sells brand-new, authenticated goods procured in other countries for discounts of up to 40% on the mainland. This shift challenges luxury brands that rely on exclusivity and tight pricing controls to maintain their prestige and profit margins.

According to a report by Bloomberg, the value of LVMH goods sold over Dewu grew by 11% to 2.6 billion yuan ($358 million) in the first half year of 2024, accounting for more than 14% of LVMH's sales in the mainland market, which amounted to $2.5 billion. Additionally, other brands such as Dior, Hermès, Chanel, and Prada also saw double-digit growth in sales compared to the same period last year.

Dewu Dominates China’s Luxury Resale Market

According to a report by consulting firm Re-Hub, Dewu accounted for 73% of the domestic luxury resale market's revenue as of last August, while Taobao only accounted for 26%. This shift highlights the growing popularity of specialized resale platforms over traditional e-commerce giants in the luxury sector.

On the other hand, up to 70% of luxury brand products that are sold on Dewu come from grey market channels. This phenomenon raises concerns about the sustainability of these brands' profitability in the region and the future of their investment strategies.

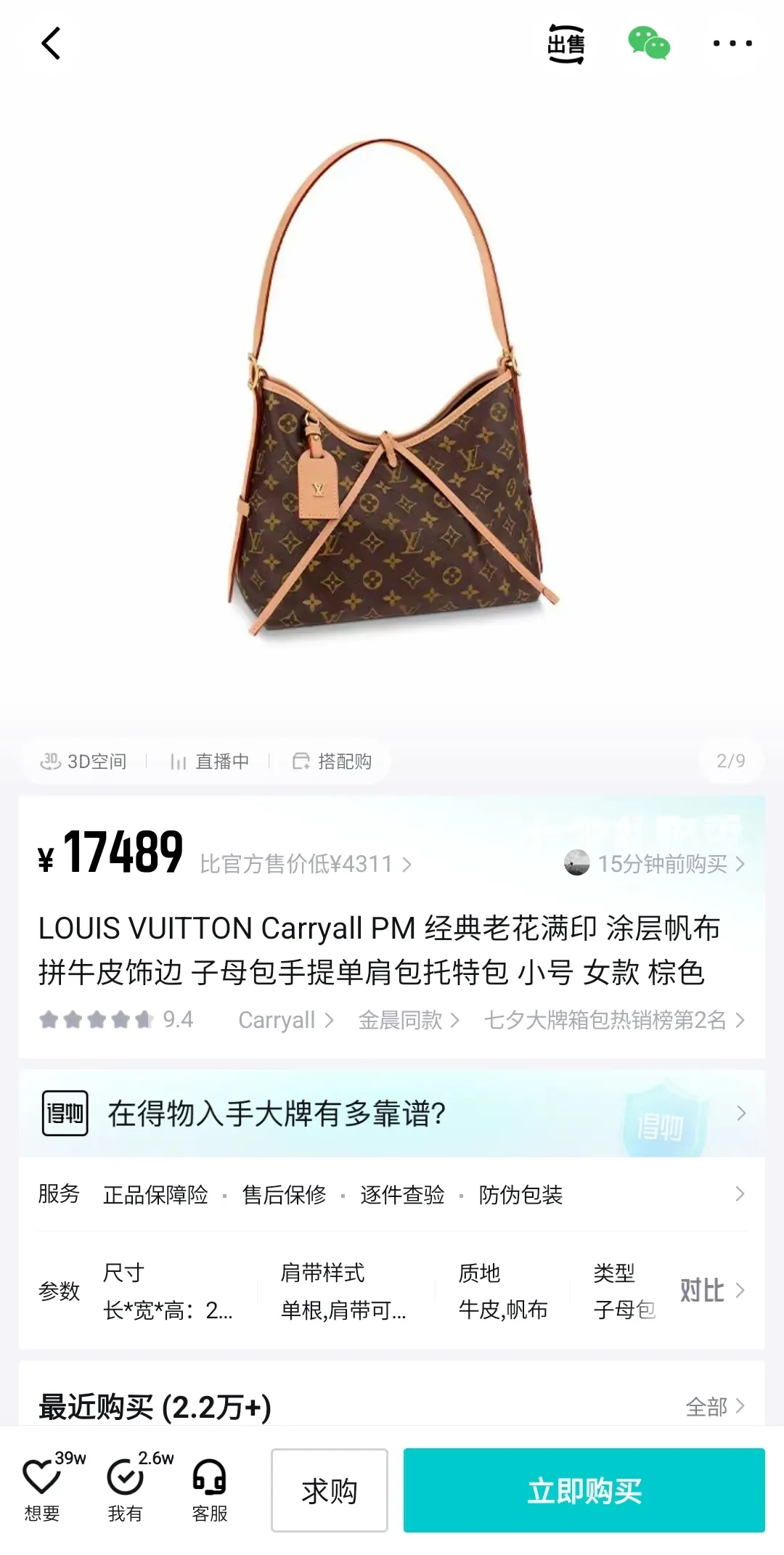

For instance, the classic black Chanel large CF bag is priced at 54,679 yuan, offering a 25,000 yuan discount compared to the official retail price while the LV Carryall bag is offered at around 20% off its original price. These substantial savings have made Dewu an attractive option for consumers seeking high-end fashion at more accessible prices.

Grey Market Goods Become the Foe of Luxury Brands

The rise of grey market goods has created significant challenges for luxury brands. These products, often sold through unofficial channels, blur the lines between legitimate retail pricing and discounted secondary markets. As a result, pricing strategies and market segmentation have become increasingly difficult for luxury companies to navigate. While consumers are naturally attracted to lower prices, luxury brand owners must find ways to protect their brand value and maintain market control in an environment where competition is fierce.

How T-Security Can Help?

To address these challenges, T-Security will suggest using a sticker label combined with our T-Cloud 3.0 monitoring system. T-Cloud 3.0 which utilized AI and big data as powerful tools for managing, tracking and controlling market prices.

Established in 1983, T-Security has more than 40 years of expertise to the table, focusing on cutting-edge technology to strengthen brand protection.

---------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Want to learn more about T-Security? Click the link below to connect with us now!